Dr Ernest Addison, Governor of the Bank of Ghana (BoG), has outlined measures taken by the central bank to assist domestic banks in dealing with the impact of the domestic debt exchange programme on their operations.

This came after the BoG conducted a stress test for the banks prior to the program’s launch.

Some have expressed concern that the debt exchange will weaken domestic banks.

For example, in a letter to Addison on the Domestic Debt Exchange Programme, Bawku Central Member of Parliament Mahama Ayariga stated that banks will face capitalization and liquidity problems if they do not receive timely and appropriate coupon payments from their bondholders.

Mr Mahama Ayariga said “I contend that the Domestic Debt Exchange Programme will emasculate domestic private banks, as they will face capitalization and liquidity problems given that they will not receive timely and appropriate coupon payments from their bond holder (Government of Ghana).

“I also contend that the directive of the Minister of Finance, to those banks he has so

emasculated, to approach the Ghana Amalgamated Trust Plc (GAT) for support from the Ghana Financial Stability Fund (GFSF) opens them up to a takeover by investors in the GAT, if the Ghana Financial Stability Fund is not wholly publicly funded.

“I further contend that political patronage and nepotism will inform the ultimate purchase of the shares in the private banks once GAT begins to dispose off these shares to realize the investments made in those banks (if GAT is not publicly funded).

“I conclude that the policy and strategic options chosen by the Finance Minister enable the

illegal and unconstitutional expropriation of the private property of the present owners of

domestic private banks and, possibly, private international banks operating in Ghana.”

But answering questions at the 110th Monetary Policy Committee (MPC) press conference in Accra on Monday, January 30, Dr Addison stated that “Yes, the stress test on the ability of the 23 or so banks to withstand the impact of the debt exchange, we did see the numbers, the implications for liquidity and the implications for capital.

“On the basis of that exercise, the BoG came out with high regulatory reliefs which we thought will help them deal with the impact on liquidity and capital. We agreed to reduce the cash reserves ratio from 14 per cent to 12 per cent on domestic currency deposits and reduce cash reserve ratio from 13 to 12 percent on foreign currency deposits. These measures give liquidity back to the banks, they address the issue of the impact of liquidity.

“We also dealt with the issue of capital by reducing the capital conservation buffer by 3 per cent, and capital adequacy ratio was reduced from 13 to 10 per cent. Even some of the technicalities surrounding the debt exchange in terms of derecognition losses, we agreed to have them restore its impact on capital over a four-year period.

“So there are a lot of things that the Bank of Ghana has agreed to do to help the banks deal with the implications of the domestic debt exchange on capital and liquidity.”

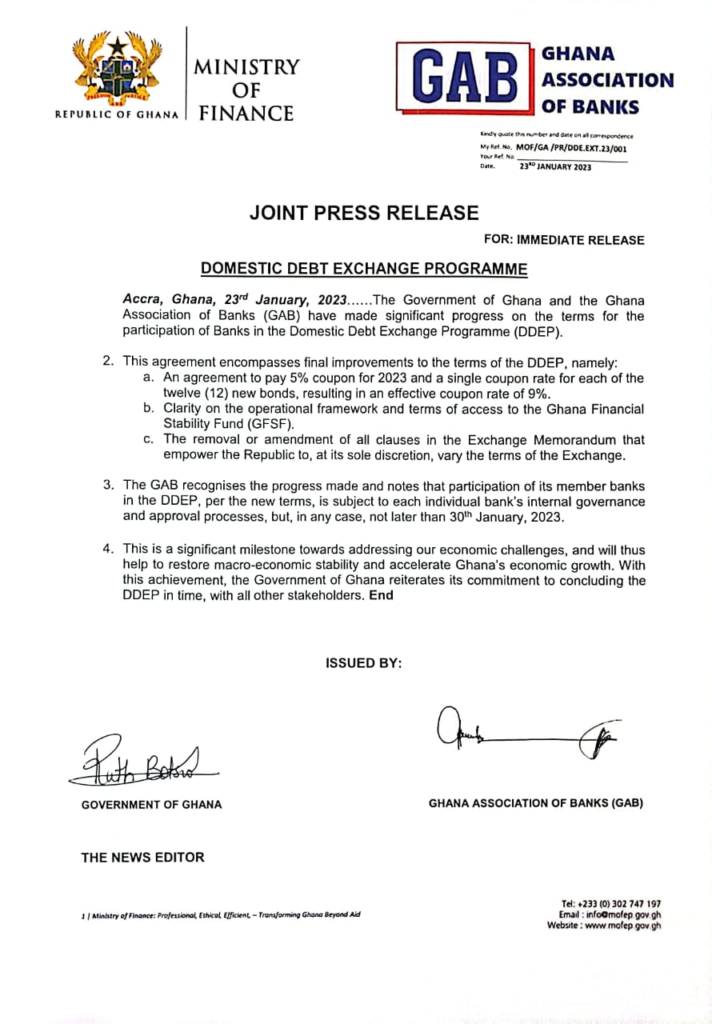

The Government and the Ghana Association of Bankers (GAB) reached an agreement on the new terms for the Domestic Debt Exchange programme.

Earlier, the banks rejected the programme as announced by the government.

The GAB directed commercial banks not to sign onto the amended debt exchange offer over uncertainty surrounding the impact of the debt restructuring on the banking industry.

The association wants its concerns addressed before accepting the debt exchange offer, according to a letter sent to managing directors of banks and seen by 3Business. GAB told member banks that may want to consider the debt exchange in its current form to formally inform the association first before doing so.

“…From the uncertainty surrounding the programme, GAB recommends that all banks must stay any further movement on the exchange until our demands have been met. However, in the event that a bank may have to move forward to exchange, the MD/CEO must inform the CEO of GAB directly of the decision,” according to the letter sent to the banks.”

However, after an engagement with the Ministry of Finance, the Association of Banks that per the new terms, the participation of member banks is subjected to individual bank’s internal governance and approval processes.

- The Bank of Ghana has committed to the FinTech agenda – Addison

- Too early to scrap E-levy – Addison

“This is a significant milestone towards addressing our economic challenges, and will thus help to restore macro-economic stability and accelerate Ghana’s economic growth.

“With this achievement, the Government of Ghana reiterates its commitment to concluding the DDEP in time with all other stakeholders,” a joint statement from the Finance Ministry and GAB noted.

The deadline for all to voluntarily sign up for the Programme was for the third time extended on Monday, January 16 to today.

The decision was to allow the government to further engage with bondholders.

Within the period, agreements were reached with the Ghana Association of Banks (GAB), the Ghana Insurers Association (GIA) and the Ghana Securities Industry Association (GSIA).

The government had initially extended subscription to the Programme from Friday, December 30, 2022 to Monday, January 16, picking the following day as Announcement Date.

Per that schedule, Tuesday, January 24 was slated for settlement of invitations.

With Tuesday, January 31 as the latest deadline, it is expected that Wednesday, February 1 will be the Announcement Date.